Table of Content

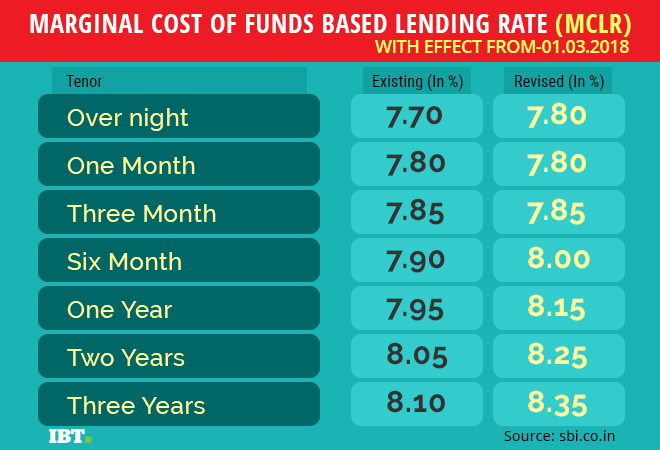

With this, the bank’s one-year MCLR now stands at 8.30 per cent, while for 3 years, it stands at 8.60 per cent. If your home loan is on a Marginal Cost of Lending Rate , the rate reduction will not have an immediate impact. Your loan rate will change every year based on the prevailing rates. So, if your loan was booked on 1st January 2018, the interest rate will reset 1st January every year based on the prevailing MCLR rates, irrespective of the changes made by the bank in between.

SBI home loans are the preferred choice of millions as it comes to you with trust and transparency embedded in the tradition of the State Bank of India. The State Bank of India is known to offer home loans at attractive interest rates with the privilege to repay the loan at a flexible tenure and budgeted EMI plan. Moreover, there are no prepayment charges and minimum processing fees required on the sanctioning and disbursal of the loan amount. With its exclusive packages, SBI has managed to help over 30 lakh families to fulfil their dreams of owning a home. At the CNBC Awaaz Real Estate Awards 2016, SBI was declared the winner and honoured with the title of the “Best Home Loan Provider”. The bank is providing lower interest rates during the festive season.

Processing Fee for availing SBI Home Loan

The customer who already took home loan from SBI Bank and needs more amount, they can opt for home top up loans. Customers have a satisfactory repayment track record of 1 year or more, after completion of moratorium period. The State Bank of India is known to approve for a series of home loans that varies widely in their principal sum, interest rate and the tenure for repayment. A few of these exclusive home loan schemes offered by SBI are discussed below. No prepayment or foreclosure penalties are levied on the borrowers willing to pay off their loaned amount before the tenure ends.

This loan can fulfill any of your personal financial needs. SBI Home Top Up loan is a type of loan offered by State Bank of India to meet financial requirements and can be availed as a top up over the existing home loan. SBI bank home loan offers this type loan for the tenure ranging up to 30 years. Under the revised festive offer from December 15, top-up loans have an interest rate of 9.15 per cent on credit scores of greater or equal to 800 instead of 9.30 per cent. It added that the rates are inclusive of a 5bps concession available to women borrowers.

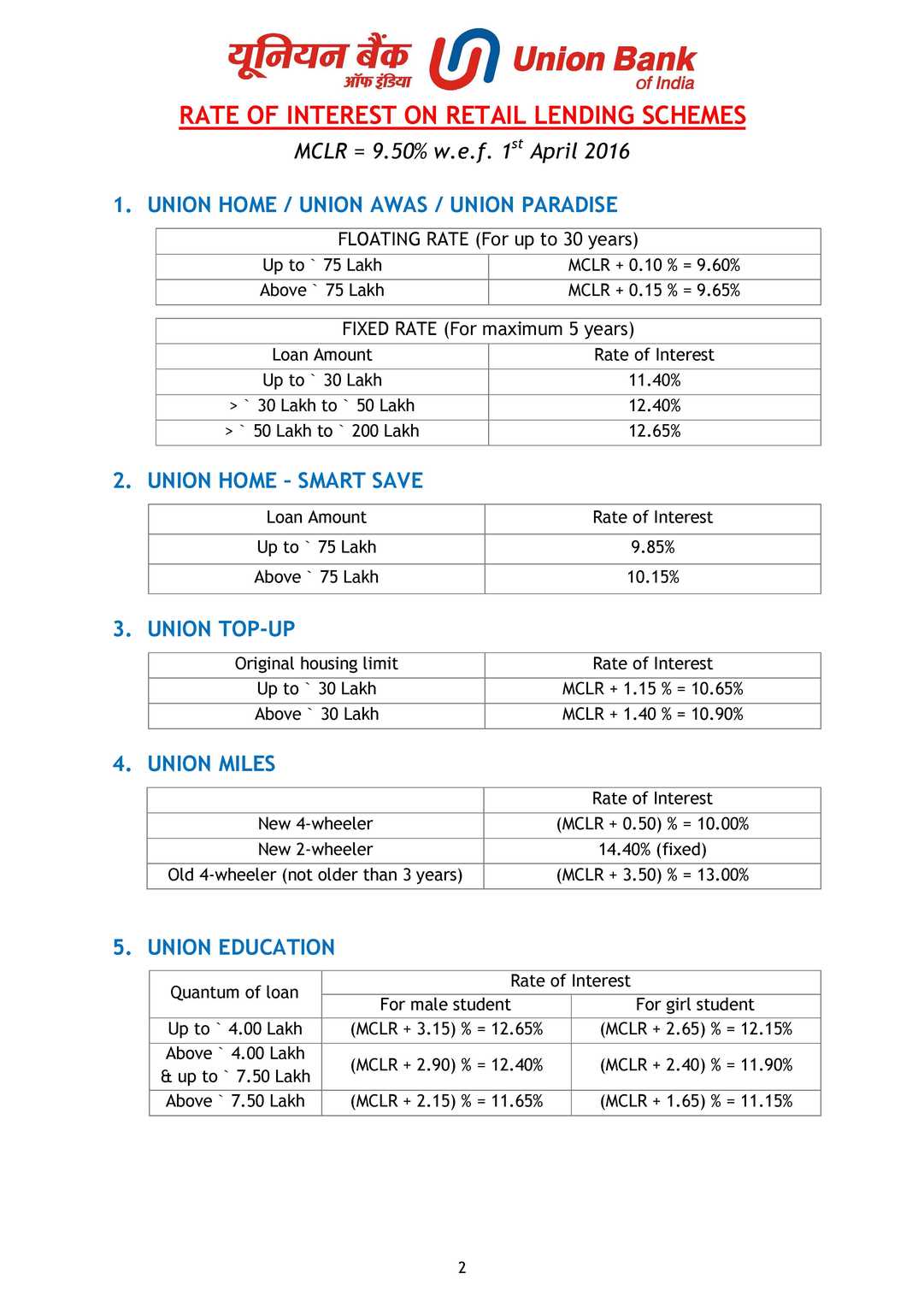

Interest Rates - Interest Rates

SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. This is the third time the MCLR rates have been increased.The bank also increased its RLLR and EBLR by 50 basis points to 7.65%. On Wednesday, the country’s largest lender, State Bank of India raised the Benchmark Prime Lending Rate by 70 basis points (or 0.7 per cent) to 13.45 per cent. The loan repayment linked to BPLR would be costlier due to this. The bank has also raised the base rate by similar basis points to 8.7 per cent.

Besides, these rates are available for salary account holders for Privilege, Shaurya & Apon Ghar as well. For a CIBIL score greater or equal to 800, the bank is offering a concession of 15 bps to customers. The revised rate under the festive offer is 8.75 per cent instead of the normal rate of 8.90 per cent.

SBI Home Loan Interest Rate for Multiple Housing Schemes

SBI has started offering home loans based on Repo Rate, the rate at which the Reserve Bank of India lends to commercial banks, from October 1, 2019. This rate is called External Benchmark Rate , which has fallen to 6.65% following 115 basis point reduction in the repo rate so far in 2020. After adding some spread to it, SBI home loan interest rates come as 8.05%-8.55% The rate is at least basis points lower than that of MCLR-based home loans.

The interest rate is also very low if you compare it with personal loans. Any salaried or self-employed Indian Citizen or NRI can apply for SBI Home Top Up Loan. You should not have any other active Insta top-up loans or home top-up loans. You can visit the nearest SBI branch to avail hassle-free top-up loans.

Under the offer, the home loan interest rates range between 8.40% and 9.05%. No processing fee will also be levied by SBI on top-up and regular home loans. Individuals must have a good CIBIL score to avail the offer. SBI offers affordable home loan interest rates that vary according to the loan amount, offered home loan scheme and eligibility (salaried/self-employed).

Salaried will get interest rates lower than their self-employed counterparts by as much as 0.15% per annum. The information contained in this website is for general information purposes only. If you have any queries, grievances or feedback regarding the SBI loans, you can contact the customer helpline. The credit score of the applicant should not be less than 750. The minimum age of the customer should be 18 years to be eligible for SBI home top up loan.

Income proofs with bank statements for the past three to six months. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc.

Now that you know the key features of SBI home top up loan, you must be wondering if you can apply for this type of loan. Well, there are some eligibility standards designed for SBI bank home top up loans that have to be met by you if you wish to avail the loan. Women are offered SBI Home Loans at special interest rates lower than normal. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. SBI will ask for a nominal fee for the balance transfer.

The repayment duration is the same as the tenure of the home loan as Equated Monthly Instalments . This is available to new home loan customers and also to existing home loan customers who have chosen the SBI Life Cover. SBI has increased its marginal cost of funds-based lending rates by 25 bps across tenures.

However, the loan amount is evaluated by considering factors like the applicant’s income and repaying capacity, age, assets and liabilities, cost of the property, etc. The interest rate varies as per the risk score of the borrowers. You can either use the offline or the online method in order to apply for a SBI home top up loan.